45l tax credit requirements

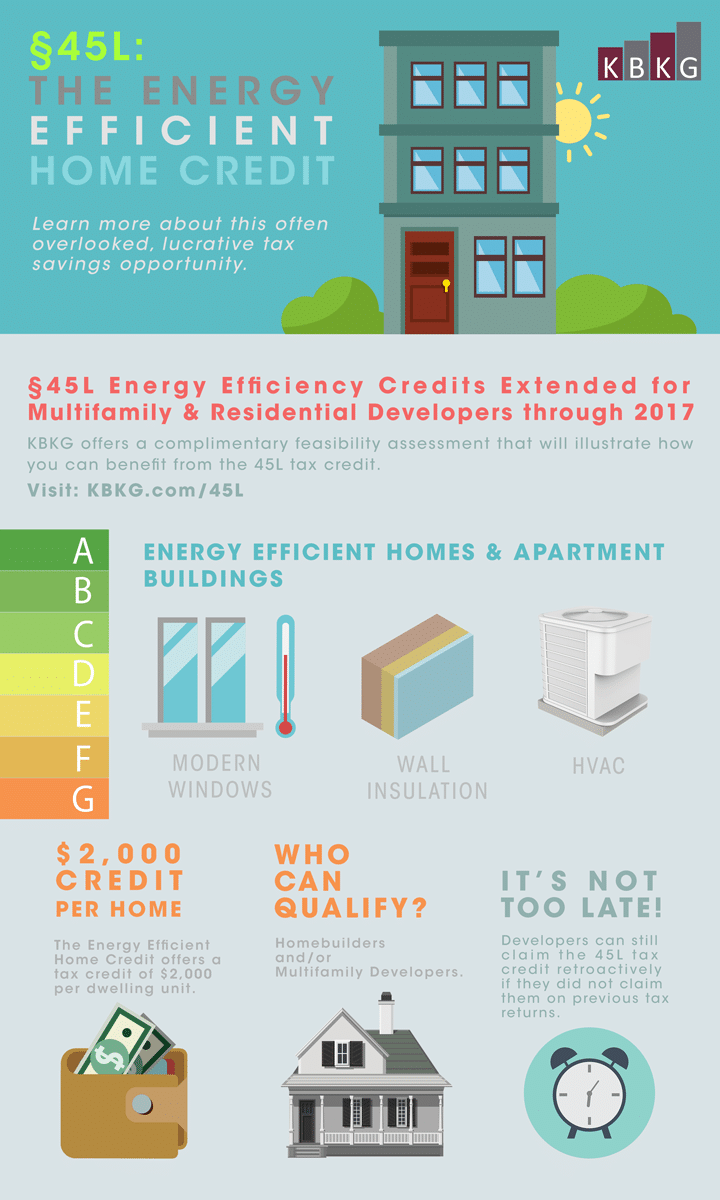

Section 45L requirements for a new energy-efficient home Before a property can be evaluated in terms of its energy efficiency it must meet certain requirements to be eligible. THE 45L ENERGY EFFICIENT HOME CREDIT The 45L Credit which currently only applies to homes leased or sold prior to January 1 2022 provides a 2000 dollar per home tax credit for.

45l Tax Credit Extended For 2021 Homes Ducttesters Inc

The maximum credits per dwelling unit are.

. To be eligible you must have. Code 45L - New energy efficient home credit. Properties that qualify for the 45L tax credit include.

June 17 2020. 2000 per unit for new energy-efficient home. New York The 45L Tax Credit offers 2000 per dwelling unit to developers of energy efficient apartment buildings and homes in the state of New York.

For this purpose heating and cooling energy and cost savings must be calculated in accordance with the procedures prescribed in Residential Energy Services Network RESNET Publication. Manufactured housing eligible for 1000 credit w a 30 reduction. A school tax liability for the.

Qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250000 for the 2020 income tax year and. The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient. Through recent passage of a new tax extenders bill the energy efficient home credit the 45L credit which provides eligible contractors with a 2000 tax credit for each.

The new energy efficient home credit as defined by Internal Revenue Code IRC Section 45L was extended increased and modified under the Inflation. August 18 2022. The 45L Energy Efficient Home Credit offers builders developers a 2000 federal tax credit per energy efficient home 2000 per qualified home Single family and m ulti-family projects up to.

Single family homebuilders and multifamily developers can benefit from the 45L Tax Credit. If you are a builder owner or developer of a residential home or apartment building you may be a candidate to earn tax credits for energy efficiency. Acquired by a person from such eligible contractor for use as a residence during the taxable year.

The version of the 45L Tax Credit that our industry has leveraged for over 15 years expired on December 31 2021 meaning that there is no active 45L Tax Credit for homes built.

45l Energy Tax Credit Passes House Awaiting Senate Vote Warner Robinson Llc

Section 45l Tax Credit Rewards Developers Of Energy Efficient Homes Our Insights Plante Moran

Section 45l Tax Credit Case Study Apollo Energies Inc

Everything You Need To Know About 45l Tax Credit Mom And More

45l Tax Credit Energy Efficient Credit For Multifamily Developers Fort Worth Inc

Csg 45l Energy Efficiency Tax Credits

Expired Tax Credits Expected To Be Renewed 2022 04 14 Achr News

Inflation Reduction Act Signed Into Law Extends And Expands Energy Efficient Tax Incentives Capstan Tax Strategies

The 2 000 45l Efficiency Tax Credit What You Need To Know Attainable Home

45l Energy Efficient Home Tax Credit Extended For 2021 By Covid Relief Bill Green Building Law Update

45l Tax Credit Energy Efficient Home Tax Credit Tax Point Advisors

45l Tax Credit Specialty Tax Advisors

Tax Credit Inspections Skyetec

Resnet Highlights Passage Of Inflation Reduction Act Including Changes To 45l Tax Credit Walls Ceilings

Understanding Section 45l Section 179d Tax Credits Wcre

Section 45l Tax Credits The Most Overlooked Tax Credit For Residential Developers Krost